Lending And Payments Market In 2029

The Business Research Company’s Lending And Payments Global Market Report 2025 – Market Size, Trends, And Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 24, 2025 /EINPresswire.com/ -- Lending And Payments Market to Surpass $18 billion in 2029. Within the broader Financial Services industry, which is expected to be $47,552 billion by 2029, the Lending And Payments market is estimated to account for nearly 0.03% of the total market value.

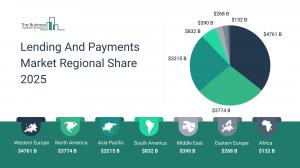

Which Will Be the Biggest Region in the Lending And Payments Market in 2029

Western Europe will be the largest region in the lending and payments market in 2029, valued at $5,963 billion. The market is expected to grow from $4,493 billion in 2024 at a compound annual growth rate (CAGR) of 6%. The strong growth can be attributed to the expansion of E-commerce, increasing digitalization and rise in the use of smartphones.

Which Will Be The Largest Country In The Global Lending And Payments Market In 2029?

The USA will be the largest country in the lending and payments market in 2029, valued at $4,905 billion. The market is expected to grow from $3,299 billion in 2024 at a compound annual growth rate (CAGR) of 8%. The strong growth can be attributed to the rise in the use of smartphones, increasing internet penetration, increasing consumer and business spending and favorable government initiatives.

Request a free sample of the Invoice Factoring Market report

https://www.thebusinessresearchcompany.com/sample_request?id=1886&type=smp

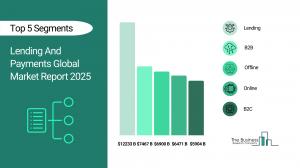

What will be Largest Segment in the Lending And Payments Market in 2029?

The lending and payments market is segmented by type into lending and cards and payments. The lending market will be the largest segment of the lending and payments market segmented by type, accounting for 89% or $16,081 billion of the total in 2029. The lending market will be supported by the low-interest rate policies, rising government loan subsidies, growing construction and real estate activities, technological advancements in digital lending, expansion of peer-to-peer (P2P) and alternative lending.

The lending and payments market is segmented by lending channel into offline and online. The offline market will be the largest segment of the lending and payments market segmented by lending channel, accounting for 49% or $8,896 billion of the total in 2029. The offline market will be supported by the continued use of cash transactions, expansion of point-of-sale (POS) terminals, adoption of chip-enabled debit and credit cards, integration of quick response (QR) code-based payment systems and government efforts to modernize retail payment infrastructure.

The lending and payments market is segmented by end user into B2B and B2C. The B2B market will be the largest segment of the lending and payments market segmented by end user, accounting for 54% or $9,722 billion of the total in 2029. The B2B market will be supported by the increasing adoption of digital payment solutions, growth of cross-border trade, integration of automated accounts payable and receivable systems, rising demand for faster and more secure transactions and advancements in blockchain and AI-driven payment processing.

What is the expected CAGR for the Lending And Payments Market leading up to 2029?

The expected CAGR for the lending and payments market leading up to 2029 is 7%.

What Will Be The Growth Driving Factors In The Global Lending And Payments Market In The Forecast Period?The rapid growth of the global lending and payments market leading up to 2029 will be driven by the following key factors that are expected to reshape financial transactions, customer engagement, and operational efficiencies across industries worldwide.

Increasing Digitalization - The increasing digitalization will become a key driver of growth in the lending and payments market by 2029. As digitalization continues to expand, it is transforming lending and payments by enabling faster loan approvals, AI-driven credit assessments, and real-time transactions through fintech solutions and mobile banking. As a result, the increasing digitalization is anticipated to contributing to a 2.0% annual growth in the market.

Growing Construction Activities - The growing construction activities will emerge as a major factor driving the expansion of the market by 2029. As construction projects surge, there is a greater need for project financing and real estate loans, while also driving the adoption of digital payments, as contractors, suppliers, and workers require smooth and efficient transactions for materials and wages. Consequently, the growing construction activities is projected to contributing to a 1.5% annual growth in the market.

Favorable Government Support - The favorable government support will serve as a key growth catalyst for the market by 2029. Initiatives such as reduced interest rates, loan guarantees, and stimulus packages are enhancing liquidity for businesses and individuals. Programs designed for small businesses and first-time homebuyers are also anticipated to boost loan demand. Furthermore, government-backed digital lending platforms are improving access to credit in underserved regions, further fueling market expansion. Therefore, this favorable government support is projected to supporting to a 1.0% annual growth in the market.

Increasing Consumer And Business Spending - The increasing consumer and business Spending will become a significant driver contributing to the growth of the market by 2029. As economic growth boosts incomes and employment, consumer and business spending are on the rise, and lower interest rates make borrowing more affordable for investments and purchases. This increase in spending is fueling higher demand for loans, credit, and digital payment solutions, driving growth in both the lending and payments sectors. Consequently, the increasing consumer and business spending is projected to contributing to a 0.5% annual growth in the market.

Access the detailed Lending And Payments Market report here:

https://www.thebusinessresearchcompany.com/report/lending-and-payments-global-market-report

What Are The Key Growth Opportunities In The Lending And Payments Market in 2029?

The most significant growth opportunities are anticipated in the unified lending and payments market, the online lending and payments platform market, and the lending and payments for B2B market. Collectively, these segments are projected to contribute over $10,371 billion in market value by 2029, driven by increasing digital adoption, seamless integration of lending and payment services, and growing demand for efficient B2B financial solutions. This surge reflects the rapid transformation of the financial ecosystem through innovative fintech solutions that enhance transaction speed, improve credit accessibility, and optimize cash flow management, fueling transformative growth within the broader lending and payments industry.

The unified lending and payments market is projected to grow by $4,753 billion, the online lending and payments platform market by $2,833 billion, and the lending and payments for B2B market by $2,785 billion over the next five years from 2024 to 2029.

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.